Basic Philosophy on Corporate Governance

Our basic philosophy on corporate governance is to achieve sustainable growth. Enhancing corporate value over the medium to long term as our most important management issue. It is essential to improve our corporate governance system to achieve these goals. We are building an organizational structure that can respond quickly to changes in the business environment, maintaining fair and transparent management as a listed company, and developing internal systems to fulfill corporate social responsibility and corporate ethics.

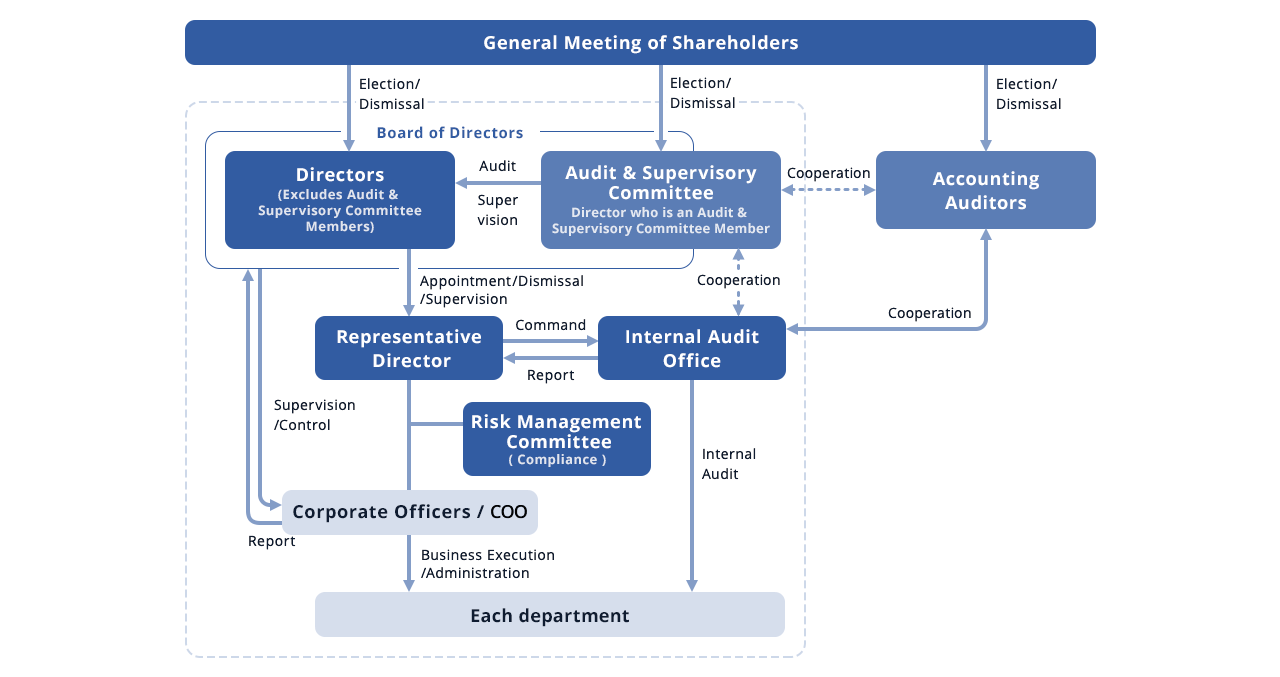

Overview of the Corporate Governance System and Reasons for Adopting this System

We have become a company with an audit and supervisory committee to enhance corporate governance. Directors who are members of the audit and supervisory committee, including multiple outside directors, will be granted voting rights at meetings of the board of directors, thereby strengthening the auditing and supervisory functions and contributing to the continuous improvement of our corporate value.

The board of directors consists of five directors (excluding those who are members of the audit and supervisory committee) and three directors who are members of the audit and supervisory committee. Three of the eight directors (37.5% of the total) are independent outside directors registered as independent directors with the Tokyo Stock Exchange.

Details of each organization are as follows.

Board of Directors

The board of directors consists of eight members: five directors (excluding members of the audit and supervisory committee) and three directors who are members of the audit and supervisory committee (all three of whom are outside directors). We have women and non-Japanese directors and appoint highly qualified professionals to our board of directors regardless of gender or nationality. The board deliberates and decides on important matters such as management policies and has the responsibility to supervise details of how business is executed. The board of directors holds regular meetings once a month and ad hoc meetings as necessary, and non-directors are free to attend meetings to ensure management transparency.

Audit and Supervisory Committee

The audit and supervisory committee consists of three audit committee members who are outside directors. They audit the conformity and validity of decision-making regarding the execution of business by the directors, the establishment and operation of internal control systems, and the methods and results of audits by the accounting auditors. It also examines whether or not the appointment or dismissal of the accounting auditor is necessary.

Open Board Meetings where non-directors are free to attend

Corporate Governance System (Company with Audit and Supervisory Committee)